Good morning. The U.S. presidential election this week has kept the topic of leadership at the forefront. One world-renowned leadership and management expert shared critical qualities that are essential for all successful leaders, whether they’re politicians or in corporate America.

On a new episode of Wharton’s Ripple Effect podcast, Michael Useem, professor emeritus of management at the school and faculty director of the Center for Leadership and Change Management. says there is a “mission critical leaders checklist” with five top components. They include: thinking strategically, acting decisively, communicating persuasively, and also revealing your character.

“People want to know who you are,” Useem says. And that includes your experience, values, and what you bring to the table as a person, he says.

And the fifth critical component is: “Honor the room. It’s a politician’s phrase, very applicable at the moment,” Useem says. That means taking time to communicate with your team, find commonalities, remind them of the strategic direction, and make sure to always tell them how essential they are, he says.

In the corporate world, all people in senior leadership positions are concerned about employees, supply chains, the communities where they operate, and “pulling those diverse constituencies together for common cause and purpose,” Useem explains.

For a political candidate, “given the great diversity in our voting public, their great challenge is to pull people together who often have very diverse points of view,” he says.

Useem thinks the art of leadership is at its core about finding common ground.

“We couldn’t find that back in 1861 when the country fell apart over the Civil War,” Useem says. “Little tough this year as well to find that. But I think the great leaders of the moment are those that can find common ground, even if it looks like there is none out there.”

Useem is also a prolific author. In one of his books, The Edge: How 10 CEOs Learned to Lead—and the Lessons for Us All, he examines the decision-making of chief executives at major companies.

In a previous interview with Useem, he told me the experience of Denise Ramos, former CEO and president of ITT, is a good example of strategic partnership. Ramos was the CFO for ITT when the company was breaking into three spin-offs, he said. The board chair asked her to become the chief executive of one of the three, he said. “She responded, ‘Well, I’m the CFO, I’m not a CEO,’” Useem recalled. The board chair said, ‘But Denise, you’ve been thinking like a CEO.”

Have a good weekend.

Sheryl Estrada

sheryl.estrada@fortune.com

The following sections of CFO Daily were curated by Greg McKenna

Leaderboard

Some notable moves this week:

Dan Swanstrom was appointed CFO of The Macerich Company (NYSE: MAC), a real estate investment trust, effective Nov. 16. He will succeed current CFO Scott Kingsmore, who will transition to a senior advisor role and will remain with the company until the end of the year.

Joanne Zach was promoted to CFO of Fathom Holdings (NASDAQ: FTHM), a real estate services company. She has served as the company’s SVP of finance since February 2021 and brings over 25 years of finance experience in both public and private sectors.

George Cardoza was appointed CFO of cloud software company SOPHiA GENETICS (Nasdaq: SOPH), which operates in the healthcare space, effective immediately. He will succeed Ross Muken, who was promoted to president of the company.

Vinay Shah was appointed CFO of Adial Pharmaceuticals (Nasdaq: ADIL), which is focused on therapies for addiction treatment and prevention, effective Nov. 16. He will succeed Joseph Truluck, who is resigning from the position to pursue other opportunities, according to the company.

Rachita Sundar was appointed CFO of software company Qualtrics, a leading online survey tool, effective immediately. She succeeds Rob Bachman, who spent 11 years at the company before departing in August to take time off with family, according to his LinkedIn profile.

Deniz Terlemez was promoted to interim CFO of Marti Technologies (NYSEAM: MRT), a Turkish transportation app, effective immediately. He succeeds former CFO Oguz Erkan, who the company thanked for his integral contributions after arriving at the company in May.

Leopoldo Alvear was appointed CFO of French banking giant Societe Generale (ENXTPA: GLE), effective Jan. 7, as part of management reshuffle under new CEO Slawomir Krupa. He will succeed Claire Dumas, who will remain at the company through the end of January before leaving to pursue other opportunities, the bank said.

Richard Hallé was appointed CFO of Natural Grocers by Vitamin Cottage (NYSE: NGVC), effective Jan. 1. He will succeed Todd Dissinger, who will retire the day prior as previously announced.

Big Deal

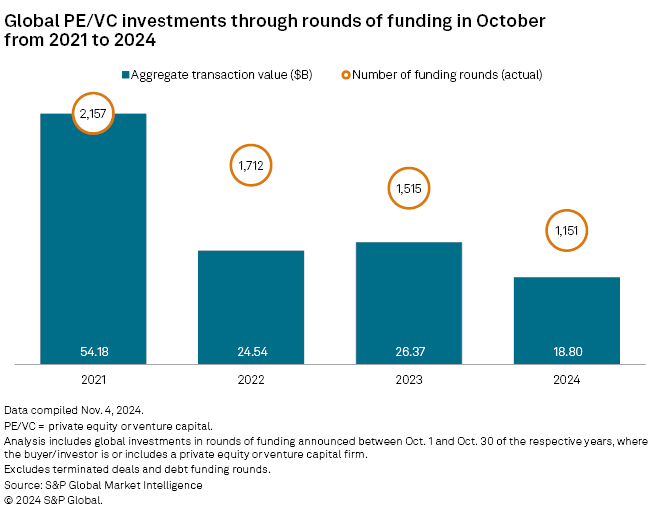

The value of venture capital funding in October fell nearly 29% globally compared to the same month last year, according to a new report from S&P Global Market Intelligence. Total deal value for the month came in at $18.8 billion, down from $20.95 billion in September.

While the technology, media, and communications sector remained the biggest recipient of investment, the month’s two biggest private equity-backed funding rounds were for energy companies. Nuclear power startup Pacific Fusion led the way, raising more than $900 million in a series A round led by General Catalyst Group Management.

Going deeper

Here are four Fortune weekend reads:

“Wall Street is foaming at the mouth with all the possible mergers and acquisitions that may now go through with Trump as president,” by Paolo Confino

“Meet the wealthy boomer Americans fleeing to Portugal, Spain, and Italy out of fear of a Donald Trump presidency,” by Ryan Hogg

“How celebrities became VCs and VCs became celebrities,” by Tatiana Koffman

“In the wake of an election that divided the workplace, CEOs must inspire unity,” by Alan Fleischmann

Overheard

“Nothing in the economic data suggests that the committee has any need to be in a hurry to get there. We are seeing strong economic activity. We are seeing ongoing strength in the labor market.”

— Jerome Powell, chair of the Federal Reserve, said about gradually lowering interest rates to a “neutral” stance after the central bank cut the benchmark rate by 25 basis points, the Financial Times reported.