Skift Take

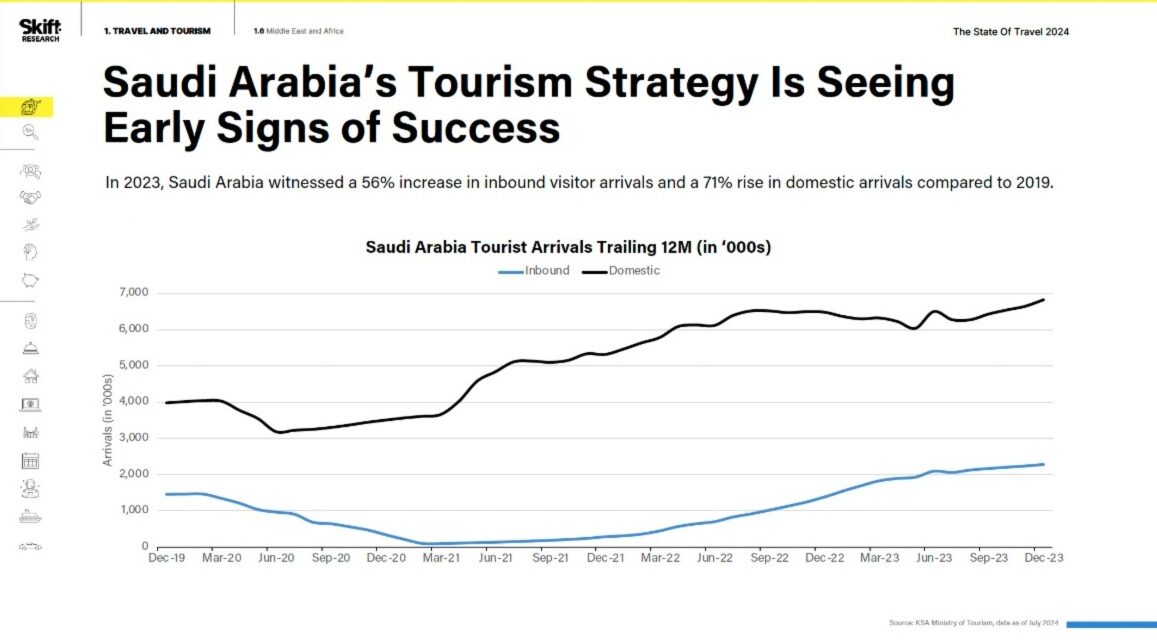

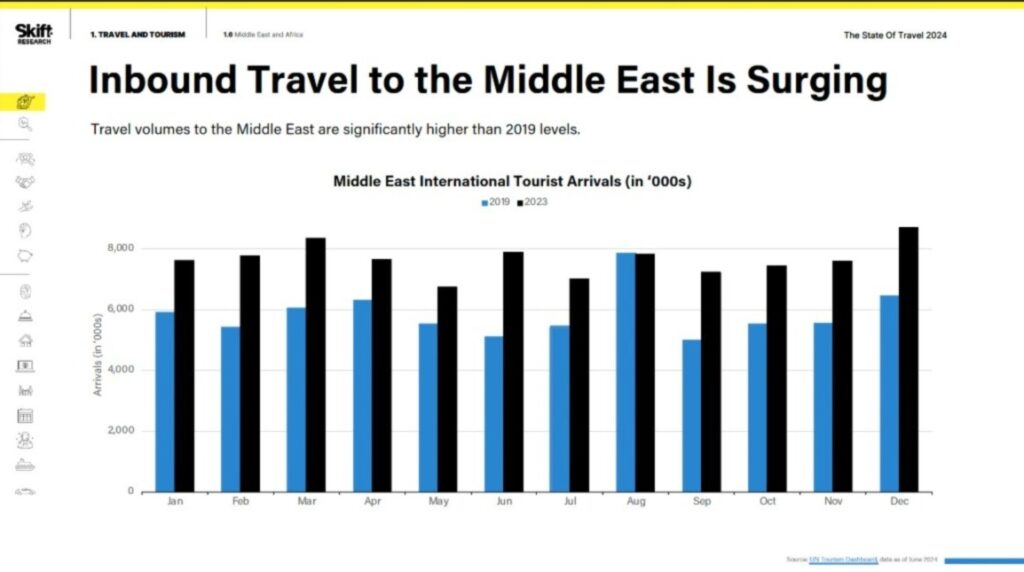

The Middle East is one of the few regions to already be ahead of 2019 tourism, led by Saudi Arabia’s transformation plan.

Skift’s State of Travel 2024 report highlighted that the Middle East and Africa are seeing a surge in international tourism, driven largely by Saudi Arabia’s push in recent years.

Here is the recent performance across Saudi, the UAE, Qatar and Egypt, four key tourism markets in the region.

Saudi Arabia

Saudi Arabia saw a combined 60 million international and domestic tourists in the first six months of the year. The kingdom did not share the split between international and domestic numbers.

Tourists in the period contributed $38.1 billion in expenditure during the first half of 2024.

Closed off to international tourism until 2019, Saudi Arabia has a target of 150 million tourists by the end of the decade, with 70 million coming from overseas. The country also wants tourism to become its second-largest industry behind oil.

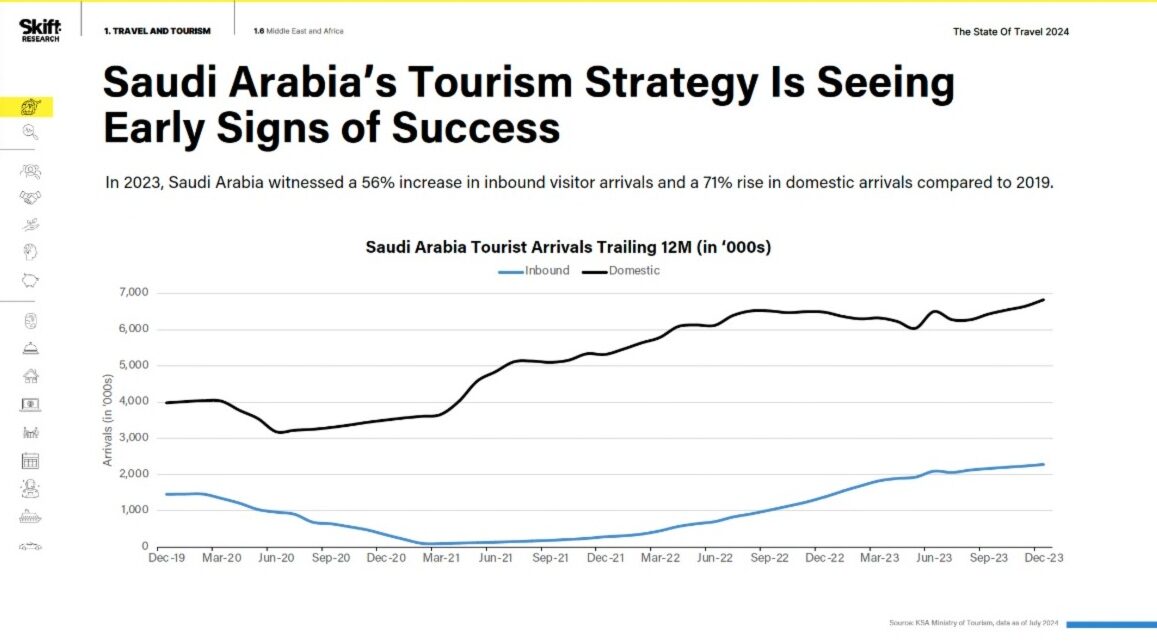

The graph below from Skift’s State of Travel report shows the extent of Saudi’s tourism growth.

Dubai

Dubai continued its upward trajectory in tourism, recording 9.31 million international overnight visitors from January to June 2024. This marks a 9% increase compared to the 8.55 million arrivals in the same period in 2023, according to data from the Dubai Department of Economy and Tourism (DET).

Visitor statistics breakdown:

- GCC and MENA Markets: 26% of total visitors, with 1.27 million (14%) from GCC and 1.09 million (12%) from MENA

- Western Europe: 20% share, totaling 1.89 million visitors

- South Asia: 1.62 million visitors (17%)

- CIS and Eastern Europe: 1.37 million visitors (15%)

- North-East and South-East Asia: 10% share (896,000 visitors), driven by recovery from China

- Americas: 617,000 visitors (7%)

- Africa: 404,000 visitors (4%)

- Australasia: 154,000 visitors (2%)

Qatar

Qatar saw 2.63 million international tourists in the first half of 2024, 28% higher than the same period in 2023.

Saudi Arabia continued to be the top contributor to international arrivals with 755,000 visitors – 29% of total visitors coming in by June of 2024.

The remaining top 10 visitor markets were India (8%), Bahrain (5%), UK (4%), Kuwait (4%), Oman (4%), Germany (4%), USA (3%), UAE (3%), Italy (2%).

Egypt

Egypt brought in 7.069 million tourists in the first half of 2024, surpassing the previous record of 7.062 million set in the same period of 2023.

Key figures:

- Tourist Nights: 70.2 million, up from 67.6 million in 2023 and 65.7 million in 2010

- Tourism Revenue: $6.6 billion, a 5% increase from $6.3 billion in 2023, and an 18% growth from $5.6 billion in 2010

- 2028 Target: Aiming for 30 million tourists

Hotel Construction in the Middle East

Hotel construction in the Middle East continues to increase as the region proves to be one of the most resilient travel markets around the globe. Data from Lodging Econometrics for the first half of the year shows 607 hotels are currently under construction in the region, with Saudi Arabia leading the charge with its ongoing economic transformation plan.

Markets such as Saudi and Egypt currently have an all-time high number of hotels being built, according to Lodging Econometrics.

Hotel Projects Being Built:

- Total projects: 607 (up 2% year-on-year)

- Total rooms: 147,088 (up 1% YOY)

Countries with the Highest Number of Projects

Saudi Arabia

- Projects: 320 (all-time high)

- Rooms: 79,756

Egypt

- Projects: 107 (all-time high)

- Rooms: 26,185

United Arab Emirates (UAE)

- Projects: 87

- Rooms: 22,831

Oman

- Projects: 28

- Rooms: 5,009

Qatar

- Projects: 27

- Rooms: 6,482

These five countries represent 94% of the projects and 95% of the rooms in the Middle East’s total pipeline.

Leading Cities in Hotel Construction

Riyadh, Saudi Arabia

- Projects: 89

- Rooms: 17,784

Jeddah, Saudi Arabia

- Projects: 58

- Rooms: 12,248

Cairo, Egypt

- Projects: 39

- Rooms: 8,789

Doha, Qatar

- Projects: 24

- Rooms: 5,794

Makkah, Saudi Arabia

- Projects: 22

- Rooms: 14,353

Dubai is notably absent from the list of the region’s largest hotel construction market. Skift looked into that fact here.

Hotel Openings and Future Projections

- First Half of 2024: 35 new hotels, 6,308 rooms

- By Year-End 2024: 66 new hotels, 13,723 rooms scheduled to open

- Forecast for 2025: 102 new hotels, 25,914 rooms

- Forecast for 2026: 121 new hotels, 24,766 rooms