Skift Take

Today’s podcast looks at Skift’s latest step to empower underrepresented voices, Meta’s new translation tech, and a lowdown on the state of Choice and Wyndham hotel brands.

Good morning from Skift. It’s Thursday, September 26, and here’s what you need to know about the business of travel today.

Listen Now

🎧 Subscribe

Apple Podcasts | Spotify | YouTube | RSS

Episode Notes

Skift is taking another big step to shape the future of travel. We’ve launched Skift Elevate, an initiative that aims to empower underrepresented voices in the industry.

Skift President Carolyn Kremins calls Elevate a movement to drive meaningful, collective action across the travel industry. Its inaugural event took place at the recent Skift Global Forum, where several prominent women in travel addressed topics such as gender equity, leadership development and inclusive workplaces.

Skift’s plans for Elevate include a series of additional events, content initiatives and industry partnerships.

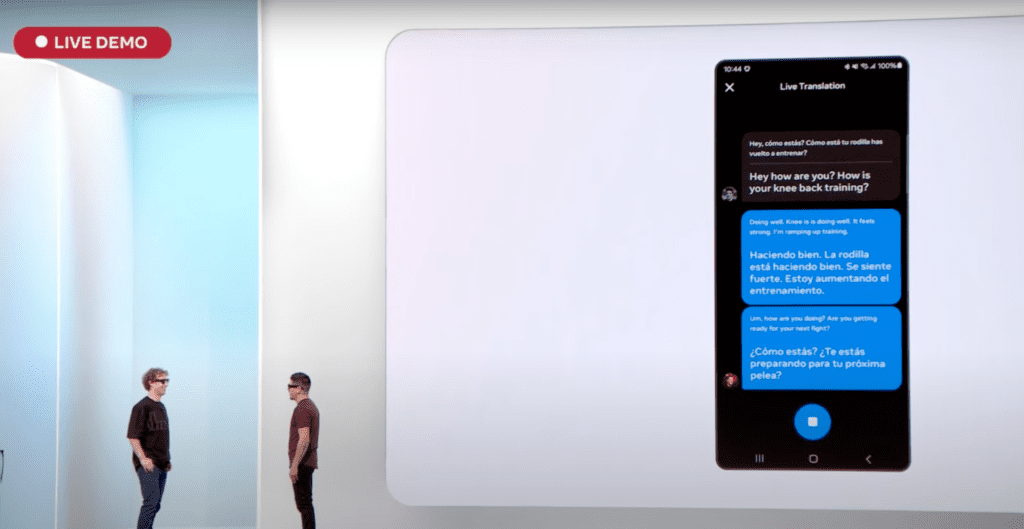

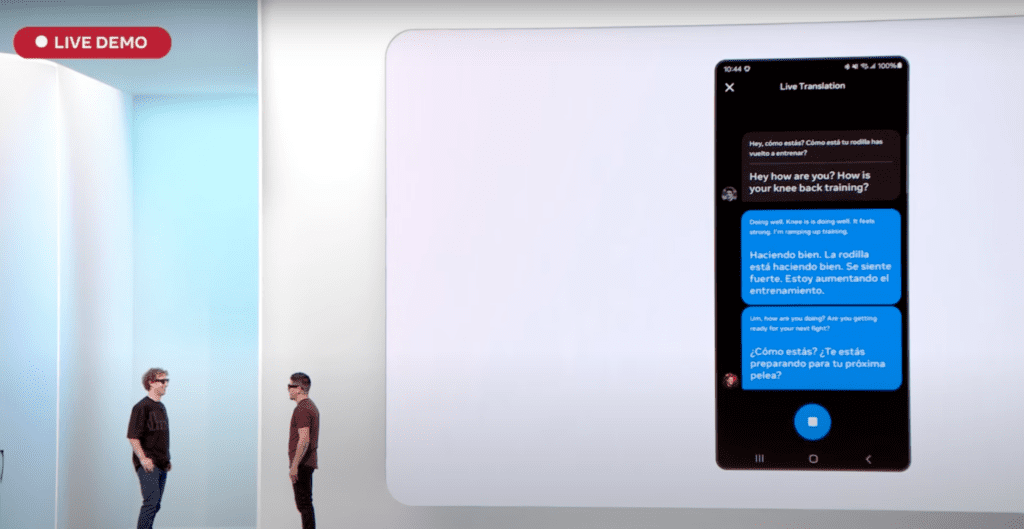

Next, the Ray-Ban Meta AI-powered glasses will have a new feature that could help travelers overcome language barriers — live voice translation, writes Travel Technology Reporter Justin Dawes.

Meta CEO Mark Zuckerberg demonstrated the new feature, among other updates, at the Meta Connect developer conference. Zuckerberg said a user wearing the glasses should be able to hear a real-time English translation of Spanish, French, or Italian through a speaker in the glasses. A translation from English to the other language comes through the app.

Meta didn’t reveal when the update would come out but said it has plans to add more languages in the future.

Finally, Senior Hospitality Editor Sean O’Neill compares the state of hotel giants Choice and Wyndham following Choice’s failed attempt to merge with Wyndham earlier this year.

O’Neill uses figures gathered by three research analysts to list Choice and Wyndham’s strengths and weaknesses. Wyndham is taking advantage of the expected $1.5 trillion infrastructure investment in the U.S., which could increase demand for its three extended-stay brands. However, Wyndham has reset its full-year guidance lower, indicating some strain on its revenue per available room.

As for Choice, it’s in a position to generate higher fees per room on average due to most of its rooms being in the midscale or upper midscale sector. But the company’s revenue per room growth in the U.S. has been underwhelming.