Skift Take

Jordan had a good summer for tourism, but that didn’t last long.

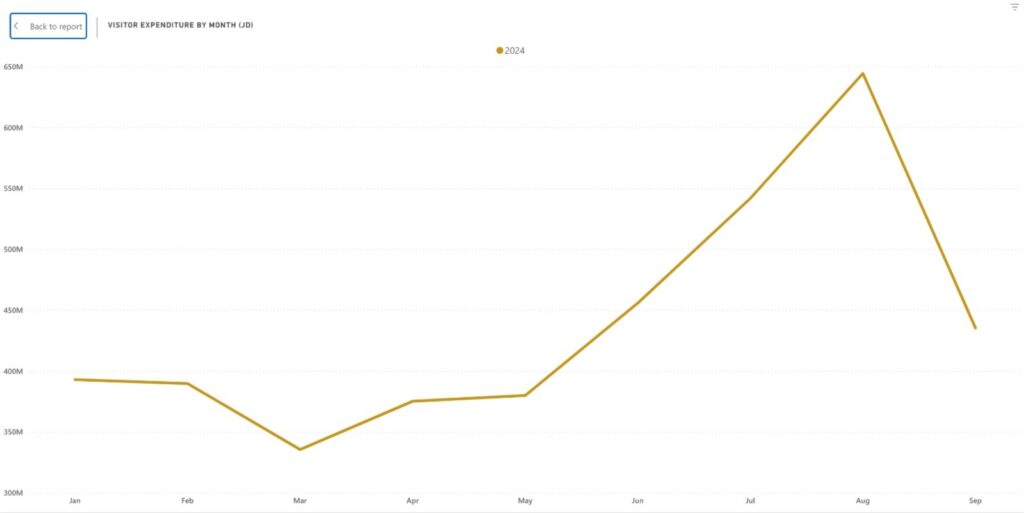

August was Jordan’s busiest month of the year with 654,000 overnight arrivals. Then came a big drop: There were just 429,000 overnight arrivals in September, a 34% decline, according to data from Jordan’s Ministry of Tourism and Antiquities.

For the year through September, arrivals fell 7% to 4.7 million.

Arrivals from European and American countries dropped 38% during the same period, and their spending through September has significantly declined. Revenues from European, American and other foreign tourists dropped by 54%, 39% and 20%, respectively.

Across all source markets, spending from August to September was the biggest drop of the year, falling 32% in a month to $61.4 million.

- 54% of all visits to Jordan are by travelers from Arab countries.

- 29% are by Jordanians visiting from abroad.

- 11% come from European countries.

- 6% come from American and Asian countries.

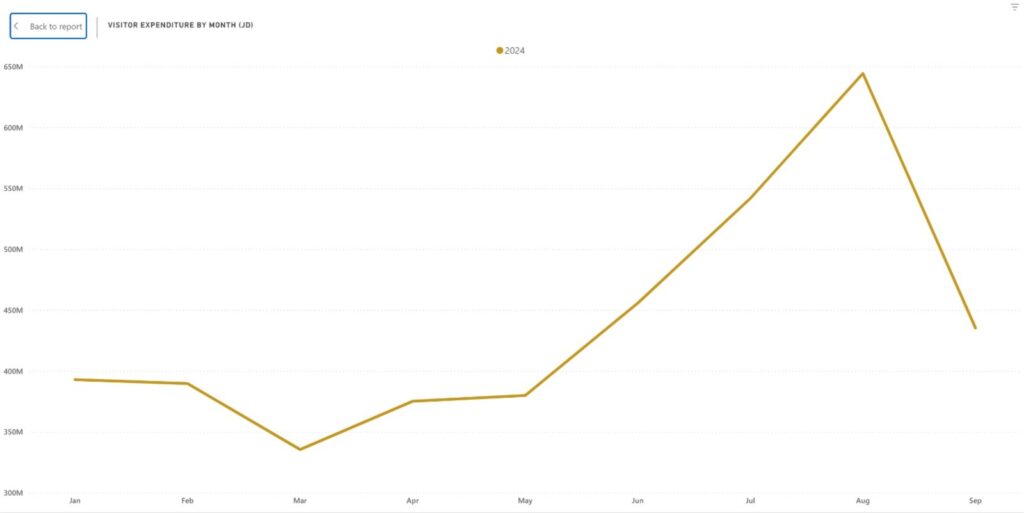

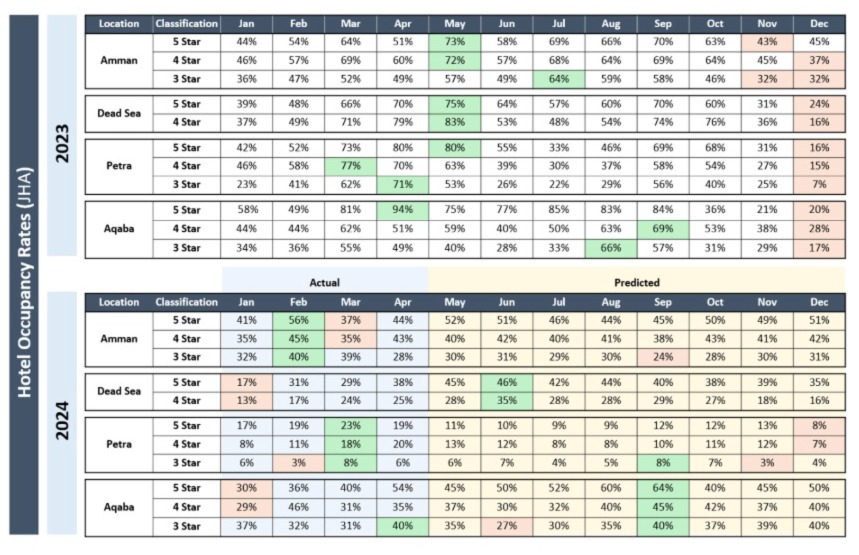

The hotel occupancy rate for Jordan through September was 33% across its 681 hotels and 32,000 rooms. Jordan’s hotel occupancy has never been above 40% as far back as the ministry’s data goes to 2012.

The table below shows the occupancy rates in hotels across Jordan’s four largest tourism markets: Amman, the Dead Sea, Petra and Aqaba. It shows Petra is projected to struggle for the rest of the year with occupancies rarely going above 10%; while the capital Amman performs better with occupancies of around 50%

The war in Gaza has led to numerous airlines temporarily exiting the market, or reduce operations. Ryanair reduced its routes to Jordan from 25 to three, easyJet canceled all its flights. In 2023, these carriers operated 2,925 flights to Jordan, carrying 445,856 tourists, 82% of which were international tourists.

Jordan’s tourism ministry has previously said it will “endeavor to compensate such losses” by providing financial incentives to airline operators, such as low-cost carriers, charter flights and regular operators, including Royal Jordanian.