Skift Take

Easing congestion. Adding air capacity. India has a long list of areas to invest in to capitalize on strong travel demand.

Tourism accounts for nearly a quarter of Thailand’s economy and a tenth of Turkey’s. For India, the contribution is just 5%. But the plan is now to double that contribution.

Suman Billa, additional secretary for India’s Ministry of Tourism, said it’s possible, but there are several areas India needs to work on:

Easing congestion: India has already been spending on destination development, such as the Kashi-Vishwanath corridor and Ayodhya revamp. Several destinations are also implementing tourist registration systems to prevent overtourism. However, this effort would have to be more widespread.

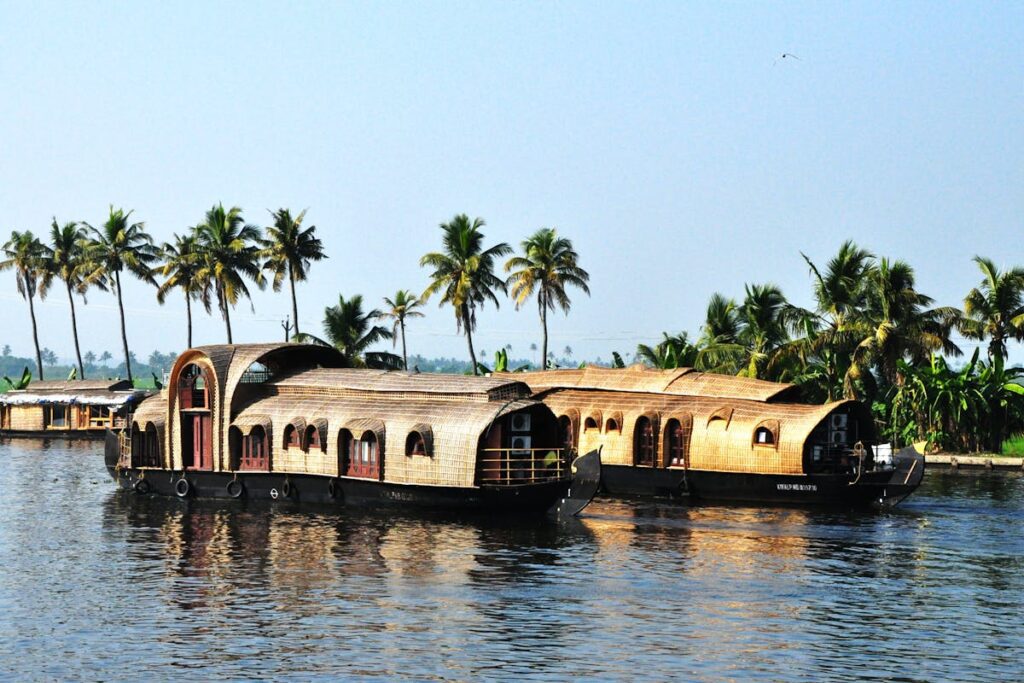

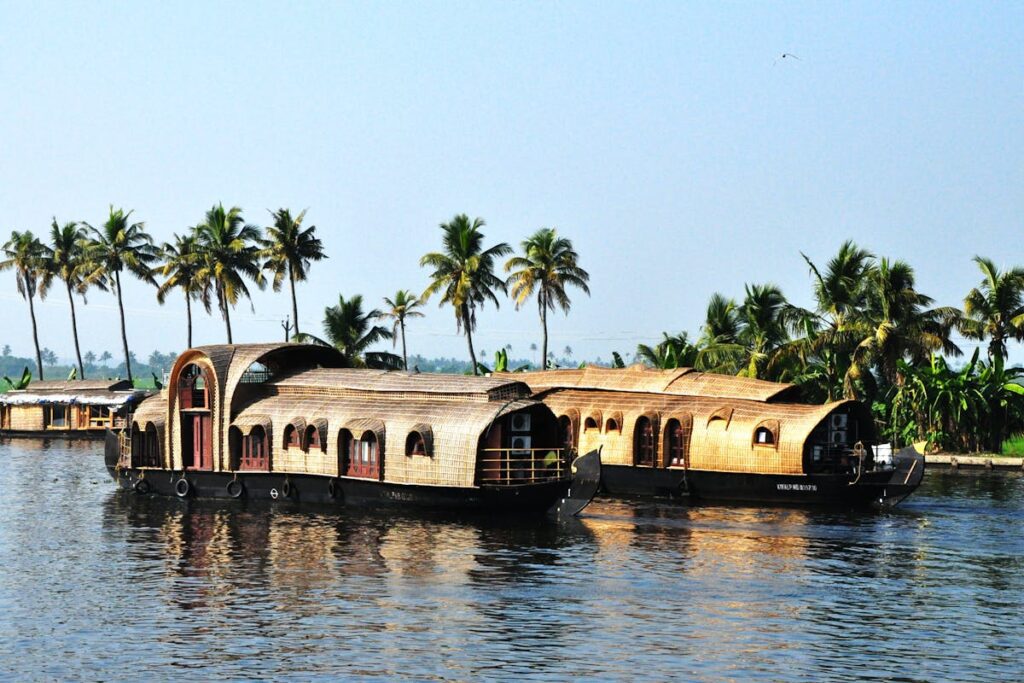

Developing new destinations: Funds are also being allocated to develop new travel destinations. The Indian budget has given a boost to spiritual and religious tourism in Bihar and focused on developing tourism in Odisha. But India would still need to develop new and emerging destinations to avoid overtourism during peak travel periods.

Increasing airline capacity: The aviation sector in India is also expanding, however demand clearly exceeds supply. According to aviation analytics firm OAG, India’s domestic airline capacity was about 15.6 million in April this year, up from 8 million in April 2014. India is now the third-largest domestic aviation market. Air India and IndiGo have been increasing their international network and awaiting delivery of massive fleet orders. New airline Akasa has also entered the international market.

More airports: The number of airports in the country has increased from 74 in 2014 to 157 at present.

At the event, Billa said these strategies could bring up tourism’s contribution to GDP to at least 10%.

The number of international tourists to India has not recovered to pre-Covid levels. Even then, the highest number of inbound arrivals to the country has been less than 11 million. Inbound tourism generated a revenue of $30 billion for India last year, Dipak Deva, managing director of Travel Corporation India, said in an episode of the Skift India Travel Podcast earlier this month, while advocating for a change in the way the industry assesses tourism: not by tourist arrivals, by tourism revenue instead.

Need for Improvement

According to market research firm Future Market Insights, India is a prominent destination for the heritage tourism segment, especially in Asia. A report released by consultancy firm KPMG India earlier this year stated that in the 2022-23 financial year, ticketed monuments protected by the Archaeological Survey of India generated a revenue of INR 2.53 billion ($30.22 million).

However, the visitor experience at these locations falls short, Billa said. To address this, the Archaeological Survey of India and the Ministry of Tourism would need to collaborate to enhance tourism experience, he added. He also suggested incorporation of fine dining and entertainment among other amenities to elevate the experience of visitors.

Even as the ministry of tourism is looking at these strategies to boost tourism revenue, Deva said that inbound tourism in India is not being explored to its full potential, as there is a lack of global promotion. In February this year, the government slashed the global marketing budget by 97%.

Saying that the government needs to put a plan in place to promote India, Deva added, “The private sector will still promote, and make the effort, but India has lost a big opportunity.”

Ryan Prazeres, co-founder of Goa-based sightseeing travel agency OneBoard App, also told Skift that when tourists do visit India, there are reports of harassment from tours and taxi operators. “If these issues persist, quality international tourists might be hesitant to visit,” he had said.