Skift Take

Managing agency commissions through a centralized funding structure can help hotels speed up payments and reduce errors, leading to fewer inquiries. This streamlined process not only improves how efficiently hotels operate but also helps build stronger relationships with agencies.

This sponsored content was created in collaboration with a Skift partner.

Hotel bookings are rising rapidly, continuing strong growth above pre-pandemic levels. Skift Research estimates that global hotel revenues will exceed $1 trillion in 2024 for the first time ever. Of course, not all channels are growing at the same rate. A resurgence in bookings through the Global Distribution System (GDS), driven by a rebound in corporate travel and a shift towards bookings through travel agencies, highlights the perpetual significance of hotel-agency relationships.

According to the Amadeus Hospitality Market Insights Report for September 2024, GDS was the only channel globally to show an increase compared to other channels (Brand, CRS, Direct, and OTA), gaining 2 percentage points in market share year over year. For hotels, this indicates a crucial need to continue refining how they manage agency commissions. As significant transaction volumes flow through third-party travel channels, mastering timely and effective commission payments will be an essential consideration.

The previous edition of “The Data Snap” explored how hotels can use the most efficient funding methods to increase efficiency and optimize their relationships with critical agency partners. However, funding methods are not the only issue to consider. The choice of funding structures also plays a crucial role in managing commissions and ensuring smooth transactions, directly affecting both payment speed and agency satisfaction.

This article highlights various commission funding structures within the hospitality industry, their impacts on operational efficiency, and the importance of fluidity of financial interactions between hotels and agencies.

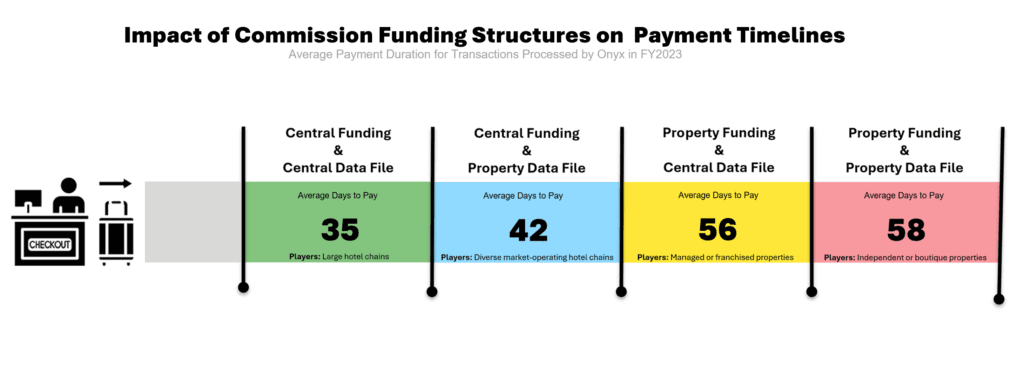

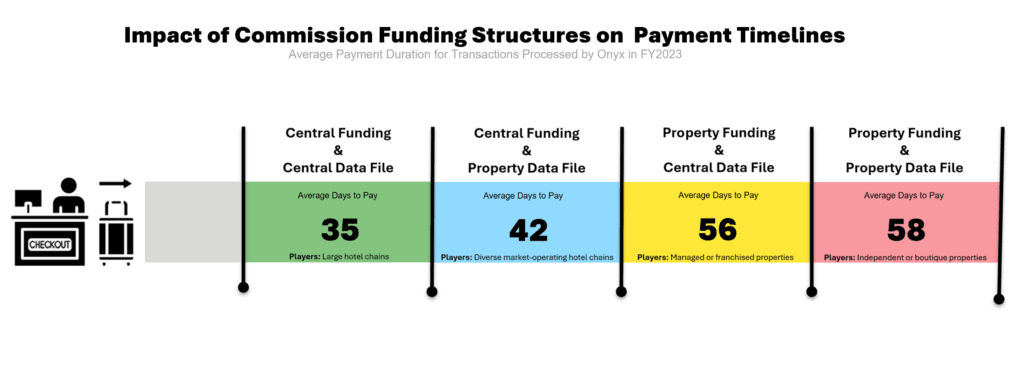

How Funding Structures Affect Time to Payment

Payment timelines vary significantly across different funding structures, with a notable reduction in average days to pay in more centralized systems. Hotel companies that use a centralized funding structure across their organizations, in contrast to funding commissions through each individual property, can reduce their average days to pay by nearly 40 percent. OnyxInsights data shows that the funding structures preferred by large hotel chains average as few as 35 days to pay, in contrast to those typical of independent or boutique properties, which average nearly two months.

How Different Funding Structures Work

The details of different funding structures are complex, and there are specific reasons why certain property types or organizations may use them. The image below illustrates how four prominent commission funding structures work as funds are routed from the hotels through Onyx CenterSource and onto agencies as designated.

While the visual shows the types of organizations that typically use each funding structure, it’s important to note that there are exceptions. For example, some global hotel chains choose Property Funding and Property Data File setups because they prefer financial independence and local management. While this approach offers more control at the hotel level, it can negatively affect key performance areas overall. It can lead to problems like slower commission payments, which are crucial for maintaining a good brand reputation and strong partnerships in the hospitality industry.

How Certain Funding Structures Can Nearly Eliminate Inquiries and Expedite Commission Payments

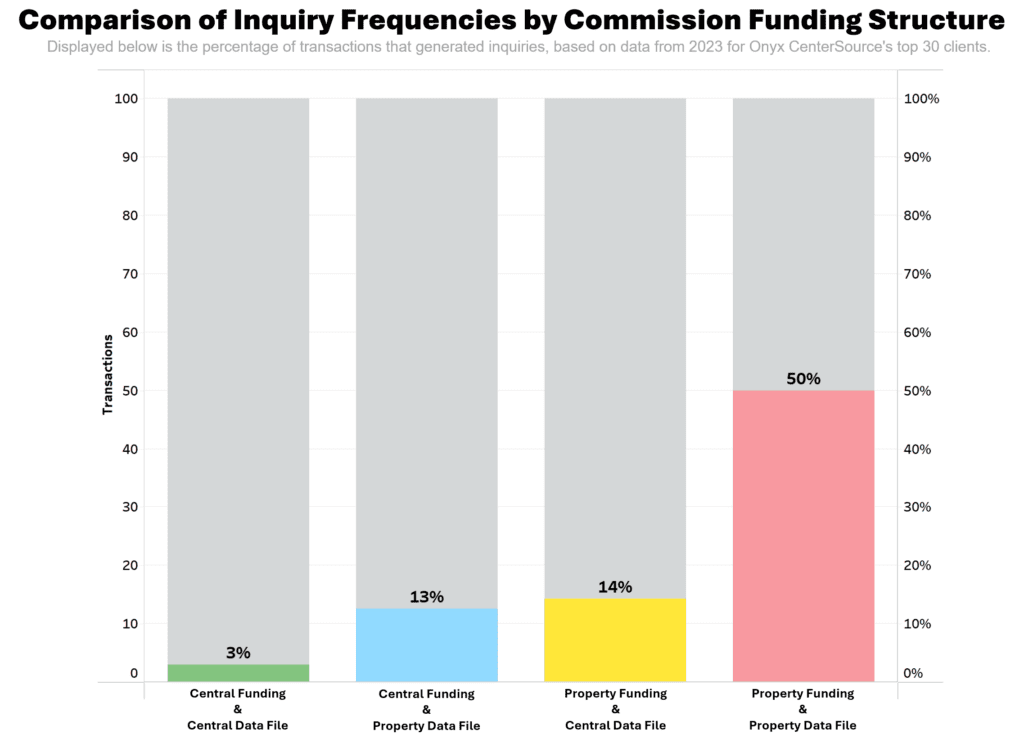

Beyond payment timelines and cash flow, the number of agency inquiries about missing commissions is another important consideration in hotel-agency partnerships. According to OnyxInsights data, there’s a clear connection between the funding structure used and the frequency of these inquiries.

Hotels with decentralized setups, like Property Funding and Property Data File, tend to receive far more commission-related inquiries. Half of all transactions set up in this structure received inquiries, compared to only 3 percent of transactions in the Central Funding and Central Data File structure. These unnecessary follow-ups can drain resources and hurt overall brand trust.

This clear link between data management and inquiry rates highlights the importance of choosing the right funding structure to improve operations and maintain strong relationships with agencies. As discussed in last month’s Data Snap, the adoption of direct debit, along with centralized funding models, further enhances this efficiency.

If possible, all hotel companies should consider this combination of funding methods and structures. Together, these strategies can reduce delays and financial discrepancies. Streamlined processes not only lessen administrative burdens but also enhance the hotel’s appeal as a preferred partner for agencies and bolster its market positioning in a competitive industry.

“The Data Snap” is a monthly article series that paints a clearer picture of the dynamic hotel booking landscape, empowering hotels and agencies to make data-driven decisions that help them build productive partner relationships and drive more revenue.

OnyxInsights offers a comprehensive view of the industry landscape, enabling hotels and TMCs to make well-informed decisions and better serve their clients and partners. Onyx CenterSource processes over 100 million transactions annually on behalf of 200,000 agencies and 150,000 hotels globally, representing nearly $2.1 billion in hotel commission payments. Visit onyxcentersource.com to learn more.

This content was created collaboratively by Onyx CenterSource and Skift’s branded content studio, SkiftX.