Skift Take

Local Law 18 hasn’t yet led to a significant amount of additional long-term housing in NYC and hotels are thriving. But small-time hosts have lost a key source of income. Modifications, and a more balanced approach, are needed.

Published September 1, 2024

Malaika nearly wiped out her retirement savings a decade ago to make a downpayment on a two-family home in Brooklyn’s Ocean Hill neighborhood.

To make the math work, Malaika planned to rent out the downstairs apartment while living upstairs with her two sisters, one of whom purchased the home with her. But skittish about taking on long-term renters who might turn into hard-to-evict squatters, Malaika (not her real name) put the apartment on Airbnb.

She prided herself on giving her guests, many from foreign countries, an affordable stay in a place filled out with African pillows, masks and mud cloths, and the opportunity to experience an authentic piece of the city. “I say in my listing this is the real Brooklyn. If you don’t want to stay in the real Brooklyn, this is not the place for you,” Malaika says. “New York City is a place of grit and culture, and guests had a real appreciation for that.”

Everything was going well for her — and many other short-term rental hosts. She quit her job in 2022 as a healthcare administrator to focus on real estate investing. “I did that with the idea that my two-family home would support me in doing so,” Malaika says. “Little did I know that on the horizon, New York City, the Office of Special Enforcement, and the mayor had a very different plan for me.”

Everything changed one year ago – on September 5, 2023 – when New York City began enforcing Local Law 18.

This host registration law limits stays of fewer than 30 days to two guests, requires that there be no locks on internal doors, and that hosts be physically present during the reservation. Owners of one- and two-family homes can register as hosts only if they want to stay together in the same unit as their guests. They otherwise are restricted to listing their homes for stays of 30 days or longer, which doesn’t require registrations.

Join Airbnb CEO Brian Chesky at the travel industry’s premier event.

Sept. 17-19 in New York City

Save Your Seat

When the law went into effect, Malaika turned the apartment downstairs into a mid-term rental, but it often sits empty. And when her sisters moved out, Malaika converted one of the upstairs units into a short-term rental, which is permissible because she’s living there during guest reservations.

Malaika says she has lost about $2,400 in monthly income, nearly a 30% drop.

Gia Sharp, a homeowner and co-founder of RHOAR, which seeks a pause in enforcement and an exemption from the registration law for one- and two-family homeowners, says some members of the group are doing even worse. Sharp says one homeowner, with nowhere else to turn, lived in his car over the summer because he had to rent out his place so he wouldn’t lose it. Other members have moved in with family.

Regarding her own 110-year-old two-family home in Brooklyn, Sharp, who is a consultant, says since Local Law 18 kicked in, she’s had a few month-long stays in her upstairs unit, and one reservation was for a few months. “There’s definitely a few mortgage payments for income that I’m doing without, which is insane. I definitely can’t afford to replace my windows, which is thousands of dollars.”

Skift has been following efforts to crackdown on short-term rentals for more than 10 years. Those efforts have been intensifying, but New York’s experiment is among the most extreme and its impact shows what other cities can expect as they consider new regulations.

The goal of the law was to put illegal hotels out of business, to increase the supply of affordable housing and to improve the safety and quality of life for city residents who found themselves living alongside strangers and house parties.

The impact? Airbnb’s NYC business has nosedived, individual hosts have had to hustle to make mortgage payments or pay rent, while some condo owners keep earning money from short-term rentals without disruption because of a loophole in the law. Also, a black market for short-term rentals emerged that provides few, if any, protections for guests.

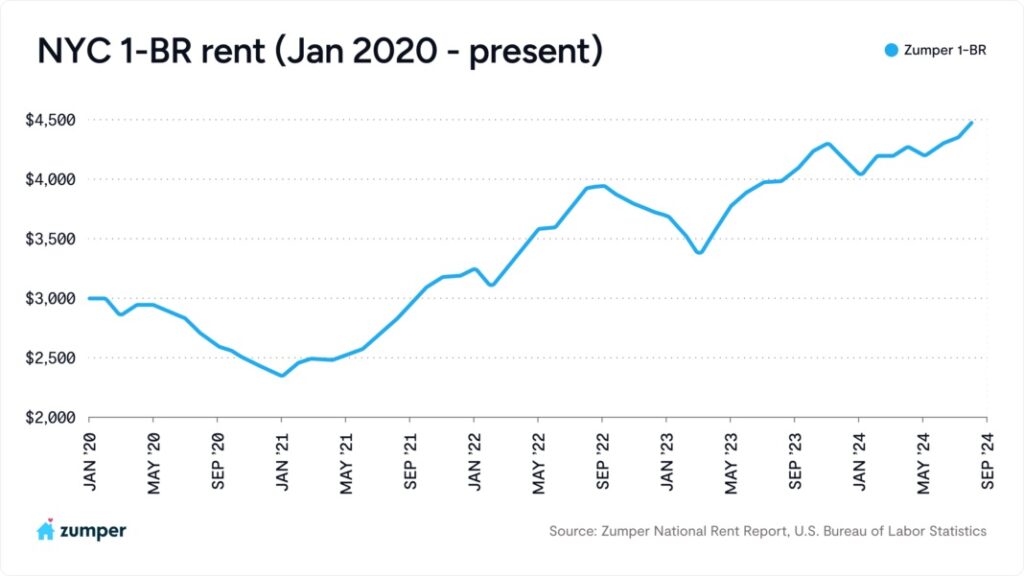

At the same time, the city’s hotel industry is booming, the local tourism board projects an increase in visitors this year, and the median asking rents in the five boroughs have risen less than 1%. However, rent for a one-bedroom apartment has soared to a record $4,500 per month. It’s impossible to measure how much of those outcomes is attributable to the new law because there are other factors at play.

New York’s Long Battle Against Short-Term Rentals

New York has been battling short-term rentals for at least a decade-and-a half.

In 2011, New York State passed the Multiple Dwelling Law, which banned stays in apartment buildings for fewer than 30 days unless the permanent resident was present. Airbnb, which had fought the law, didn’t change its listings policies after the law went into effect. Hosts were subject to fines, but they weren’t required to register with authorities.

In 2013, a Skift story pointed out that thousands of Airbnb listings were illegal under the law.

In 2021, the New York City Council adopted Local Law 18, which wouldn’t become effective for two more years. A Prohibited Buildings List now enables landlords in big apartment buildings to block short-term rentals.

The law also required platforms like Airbnb, Vrbo and Booking.com to ensure that all listings have valid registration numbers and to provide host data to the city. They face significant fines for non-compliance. An Airbnb spokesperson said last week that it has not been penalized to date.

In the interim, Airbnb, which was the largest short-term rental platform in the Big Apple, has seen its business in the city decimated, although the company won’t detail the financials.

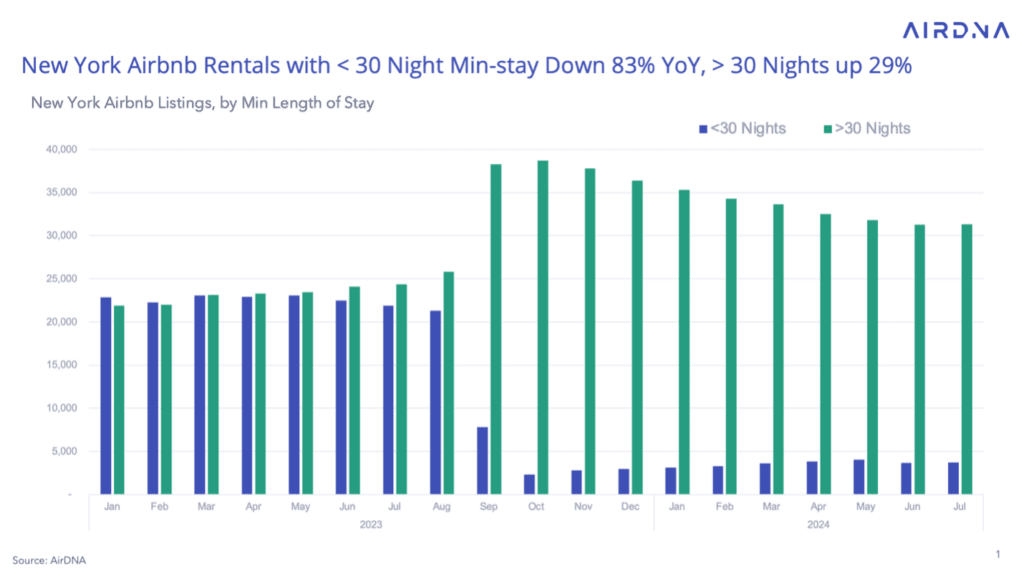

Analytics firm AirDNA found that the number of Airbnb listings in the five boroughs for stays of fewer than 30 nights — which is the primary way people travel — fell 83% from July 2023 through July 2024. That’s a drop from 21,900 listings in the run-up to the host registration law versus just 3,700 a year later.

However, Airbnb’s overall listings – including those for 30 or more nights – are down only 24%. “Many of those listings [for stays of 1-29 nights] immediately switched to allowing longer stays, 30 nights or longer, which have subsequently seen a 29% increase over the past year,” says Jamie Lane, AirDNA’s chief economist.

So if the city’s goal was to convert short-term rental listings into long-term leases, that hasn’t happened in a very significant way.

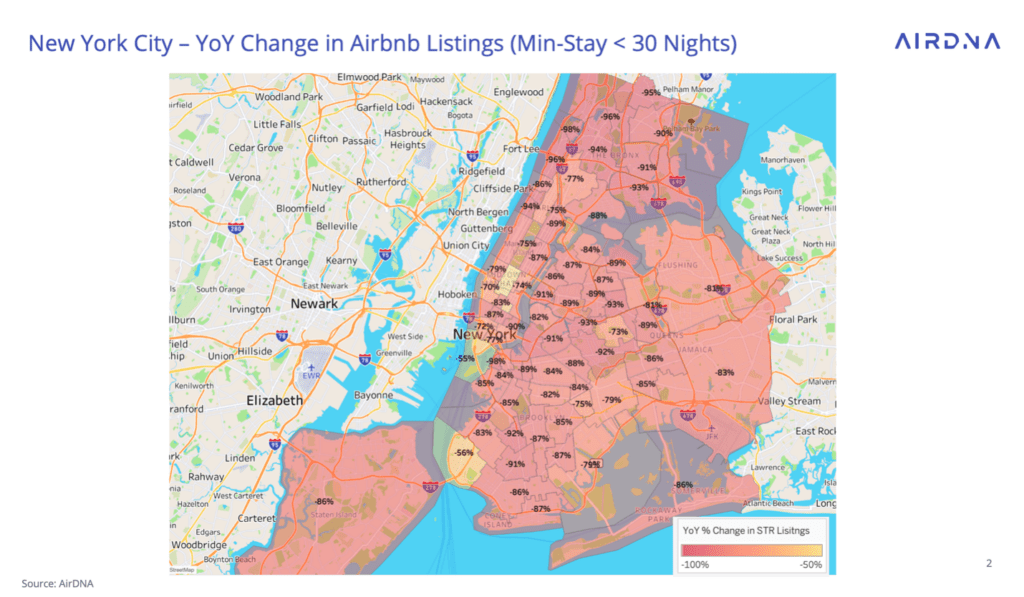

The outer boroughs, where the hotel footprint is relatively light, were particularly hard hit. “The impact on the city hasn’t been even, with a range of impacts on short-term rental listings for stays of less than 30 nights down the most in submarkets throughout the Bronx, Brooklyn and Queens with many submarkets down more than 90% year-over-year,” Lane says.

Author of Local Law 18 Speaks Out

Former City Council member Ben Kallos told Skift that he’s proud of Local Law 18, which he wrote in 2021.

“It’s good to see evidence that the number of short-term rentals in NYC has been decreased by the law I authored,” says Kallos. “This morning 33,255 children woke up in a homeless shelter and it makes me angry to learn that bad actors would rather leave their homes vacant in hopes of commanding hotel prices for 30-day stays than just renting their homes at market rates to families and children in desperate need of housing.”

Still, Kallos says the language of Local Law 18 was purposely silent on whether a host needed to be present during a stay, how many guests would be allowed, or the number of units that would be permissible. Those details were left up to the city to regulate, he says.

“I think what I was hoping to target were the Airbnb hosts who had — not one or two units — but hundreds of units,” Kallos says. “There was one person who had 400 units, and that person was in a place to have more units than some Marriott hotels or Hilton hotels.”

The travel industry’s premier annual event.

Sept. 17-19 in New York City

Register Now

Kallos added that he’s “puzzled” by how few hosts have been able to register, and he hopes the city would close a loophole that enables condo owners in Class B buildings to keep offering their units as short-term rentals without the host having to be present or any limitation on the number of guests.

For example, while small-time hosts in many cases have had to shutter their short-term rental businesses, Sonder, which operates short-term rentals in Class B buildings, cited New York City as one of its five top markets last year.

Office of Special Enforcement Points to ‘Massive Reduction’ in Illegal Listings

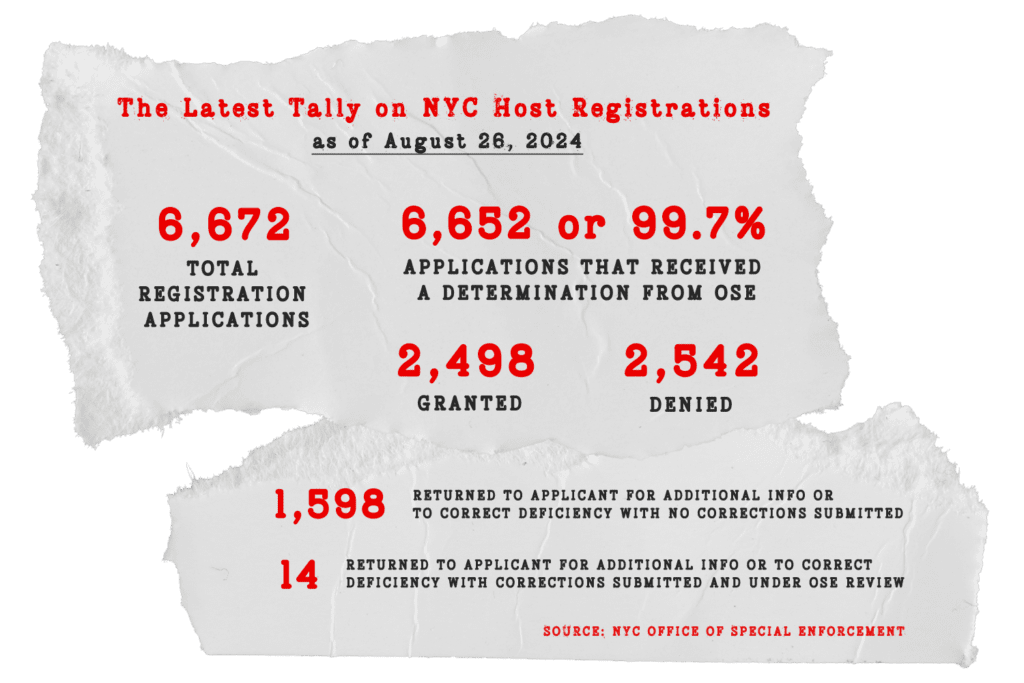

As of August 26, the city’s Office of Special Enforcement, which processes registration applications and imposes penalties for violations, granted 2,498 registration applications and denied 2542. So it has denied more applications than approved. Another 1,612 were returned to applicants for additional information or corrections.

Criticized for being very slow to process applications in the run-up to and the early days of the law’s implementation, the OSE has made a determination on 99.7% of applications. That includes those returned to hosts for corrections or additional data.

“The Short-Term Rental Registration program has been pivotal in protecting the city’s housing stock from illicit activity and keeping New Yorkers safe,” Christian Klossner, the OSE’s executive director, told Skift in June. “The implementation of the registration law led to a massive reduction in illegal short-term rental listings. It has also supported local short-term rental operators in understanding legal hosting practices. Lastly, LL18 has effectively prevented the misuse of thousands of permanent housing units for illegal short-term rentals.”

So why are so few hosts registered to offer short-term stays in the city?

As this OSE video details, hosts must not only provide identification documents, portions of their lease, and listing information, but they must also certify that they comply with zoning rules, the Multiple Dwelling law, as well as housing maintenance, construction, and building codes, for example. The nonrefundable application fee is $145.

Stanley McIntosh, a retired FEMA employee who’s in his 70s, and his wife Rosalinda Cooper, had been offering a garden-level apartment as a short-term rental in Harlem since around 2017, mostly on Vrbo. It’s part of the brownstone where they live and it has been in the family since 1938.

But for them, the registration process and new rules were too complicated.

“I was going to put in an application but the changes and the stuff you had to do would not have worked at all,” McIntosh says. “It’s crazy. The goal is just to discourage. Even if your two-family has a separate apartment, you have to be there all the time that they’re renting. It’s not like you can leave, go away and come back.”

After the law went into effect, McIntosh initially changed the listing to stays for 30 days or more, and now the couple is trying to figure out what to do next. He says the income hit means he can still pay his mortgage, but the couple can’t save like they used to.

Airbnb’s Take on Local Law 18

Theo Yedinsky, Airbnb’s vice president of public policy, says Local Law 18 hasn’t achieved its aims.

“What we said, based on experience in dealing with thousands of other cities around the world, and the data started to show this, is that it would not reduce rent prices, it would not reduce home prices, it would not increase vacancy rates, and that it would move the activity underground,” Yedinsky says.

He said it’s a misconception to think if you remove a listing off Airbnb, that it automatically turns into long-term housing. “It assumes every Airbnb that is listed on the platform is not lived in, is not a primary residence, isn’t a room, and is listed all the time, which is fundamentally not true.”

NYC Hotels the Top-Performing Major Market in the U.S.

For a variety of factors, including Local Law 18 and the fact that 16,000 hotel rooms have been taken off the market and have been used to house migrants and the homeless, the New York City hotel industry has had a banner year so far in 2024.

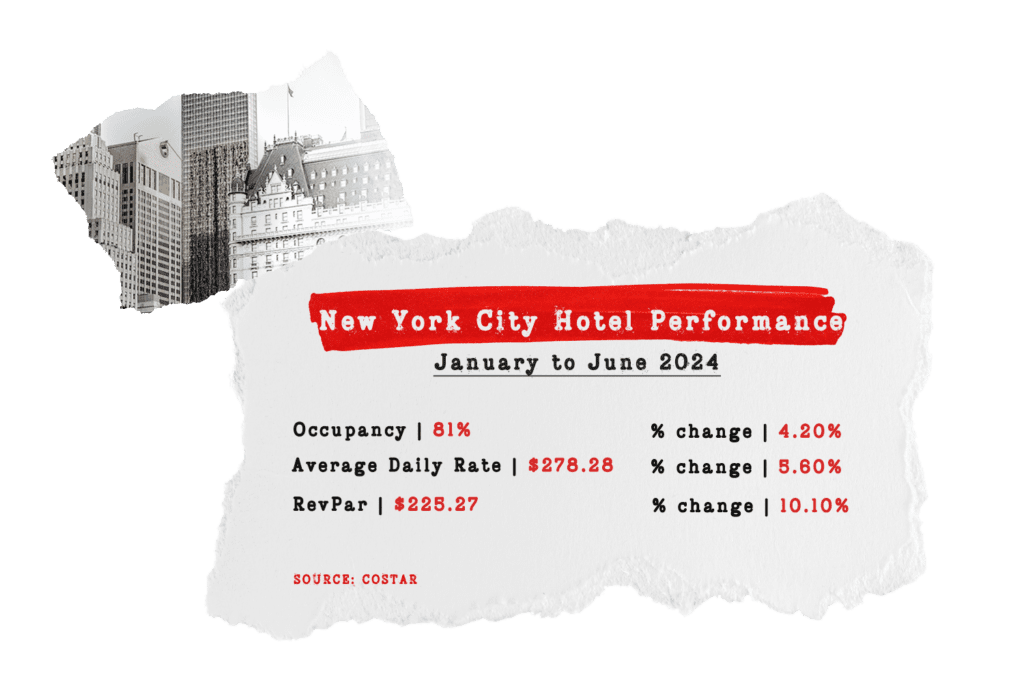

Comparing the first six months of 2024 to the same period a year earlier, New York City hotels achieved the highest revenue per available room (RevPar) increase among the top 25 hotel markets in the country, according to hotel analytics firm CoStar. It was up 10.1% in NYC, versus just 2.5% in the other 24 top markets and 1.4% in the U.S.

“New York has certainly outperformed,” says Jan Freitag, national director of Costar Group’s hospitality analytics. “The other top 25 markets are recovering as well. They are not seeing a jump of that magnitude.”

Demand is up in New York City and hotel supply was down 0.8% because of the rooms taken out for migrants and the homeless, Freitag says. As the chart shows, average daily rates and occupancy also spiked in the city.

Freitag says many of the 16,000 rooms taken off the market weren’t previously targeted toward tourists. They are located near airports, not prime tourism locations, and many had long-term residents.

“I think on the short-term rental side there’s definitely overlap between somebody who could stay in a hotel and somebody who could stay in an alternative accommodation – so I think both things matter,” Freitag says, referring to the 16,000 hotel rooms off the market and Local Law 18. “In Manhattan, maybe the alternative accommodation restriction matters a little bit more than in the outer boroughs.”

While Freitag characterized New York City as outperforming every major hotel market in the country, the CEO of the Hotel Association of New York City isn’t popping champagne or characterizing Local Law 18 as a game-changer.

“The impact has been on the margin,” says Vijay Dandapani, CEO of the hotel association, referring to the host registration law, “as NYC ’s hotel market is the only one in New York State that lags 2019 numbers …”

Regarding the administration’s response to illegal short-term rental operators, Dandapani added: “The response last year was slow due to initial teething troubles but has been robust since then.”

Dandapani claimed that CoStar’s numbers showing healthy increases in occupancy, ADRs and RevPar don’t adequately take into account 6,000 rooms that remain closed and what he estimated are 18,000-19,000 rooms housing migrants.

Although CoStar cited a 10.1% year-over-year increase in RevPar in the first half of 2024, Dandapani said, “when adjusted for inflation, RevPar is still behind 2019.”

He said Local Law 18 is necessary to “work toward closing the enormous regulatory and financial arbitrage enjoyed by STRs,” but it is still premature to assess its impact.

Visitor Numbers Are Expected to Rise in 2024

There were fears that Local Law 18 would price out bargain-seeking visitors and hurt New York City tourism overall.

In June, a Trinidadian business owner in Brooklyn who helped organize the Celebrate Canarsie event, lashed out at Local Law 18, charging that local businesses saw a “significant drop in revenue since Local Law 18 limited accommodation options for visitors.”

And the CEO of the Brooklyn Chamber of Commerce last month criticized some of the law’s “ridiculous restrictions.”

“The unintended consequences of this legislation, especially the steep decline in places for tourists to stay, are hindering Brooklyn’s potential to attract visitors and is hurting its residents, small businesses, and local economy,” chamber CEO Randy Peers wrote in an op-ed for the Brooklyn Paper.

But tourism has remained strong.

A spokesperson for New York City Tourism + Conventions said the city forecasts that the city’s visitor numbers will increase 4.2% to 64.8 million in 2024.

Tiffany Townsend, a spokesperson for the agency, claims that a lack of short-term rentals doesn’t stop people from visiting the city.

“In terms of visitor behavior, traveling is not an all-in, all-out choice,” says spokesperson Townsend. “When people travel, they generally operate within an expected budget, but then adjust what they spend. Rather than forgo a trip, they look for ways to maximize their budget and they spend differently.”

Join Airbnb CEO Brian Chesky at the travel industry’s premier event.

Sept. 17-19 in New York City

Save Your Seat

But others might argue that some budget-conscious travelers would either stay in the suburbs and commute into the city, or skip the Big Apple entirely.

Townsend says travelers may scale down their trips in several ways to still visit the city. “They may travel economy instead of premium; they may down-scale their hotel, reduce the number of nights, or go back to sharing a double-double with their children rather than booking two rooms; they generally downscale their food expenses; and finally, they often reduce their retail spending,” she says.

However, one thing the projected visitor increase can’t prove is whether — and how much — tourism arrivals might have increased even more had the city not lost roughly 18,000 short-term rental listings for stays of fewer than 30 days, according to AirDNA’s estimates.

Rents Are Up But Increases Are Slowing

With some short-term rentals coming off the market and becoming available in theory as long-term rentals, you’d think that more long-term housing supply might contribute to a dip in rents. Rents were still increasing throughout the summer.

The median asking rent in July 2024 showed just a 0.9% increase compared with July 2023.

Kenny Lee, senior economist at StreetEasy and Zillow, thinks the number of short-term rental listings involved is too small to impact the “1 million unit market-rate rental housing stock in NYC.”

However, when just considering rents for one-bedroom apartments, the median rent in September rose 12.8% year-over-year to a record $4,500 per month, according to Zumper’s National Rent Report.

The short-term rental crackdown in New York City, including the deletion of several thousand Airbnb listings, does not appear to be a needle-mover when it comes to the city’s long-term rental trends.

“The resurgence of urban living over the past two years, coupled with employers implementing return-to-office policies, have prompted many former suburbanites to return to the city,” the Zumper report says. “Additionally, the peak summer moving season is further intensifying upward pressure on rent prices here.”

Lee said that while many rent metrics in the city are approaching or at record highs, “what’s telling is the recent slowdown in the growth of various rental measures,” he said.

And there are a number of factors at play.

“I do not think the slowdown in rent growth since 2023 is related to Airbnb listings turning into long-term rentals. This is about supply and demand rebalancing rather than just short-term rentals joining the market,” Lee says. “Since 2023, the demand has been slowing in NYC as the local labor market continues to cool. Supply has been increasing as more homeowners consider renting out their homes rather than selling amid high mortgage rates and new developments entering the rental market.”

Staying In and Hosting Illegal Short-Term Rentals

With so many short-term rentals hosts unable or unwilling to register with the city, there’s been a growing black market of listings on sites such as Craigslist, various Facebook and Whatsapp groups, as well as on Discord and Telegram, for example. The short-term rental listings can sometimes take digging to find because they are mixed in with long-term rentals and sublets.

With a lack of short-term rentals where individuals or groups don’t have to stay with hosts, travelers are posting on Facebook and other platforms seeking places to stay.

Hosts often ask prospective guests to send money up-front, and there are few consumer protections if the listing turns out to be a scam, or there are other issues.

For example, a seller on Facebook Marketplace listed a one-bedroom condo in June for $130 per day (plus $10 per person if extra guests). I messaged asking whether it would be available as a short-term rental in mid-September for two guests.

Unlike the process on an established short-term rental platform, he detailed how the booking process would work. “I will require a video call where we show each other’s ID before moving forward,” the seller said. “Half the payment to take the listing off and I will authorize you access for the agreed dates. Full payment required on the first day.”

The OSE advises guests to immediately call 911 if they are fraud victims, and otherwise to use “the major sites that have insurance, customer service support, and are complying with the registration law.”

Klossner of the OSE said his office has “not seen evidence of an extensive ‘black market’ or underground illicit activity.”

Marcus Räder, the founder and CEO of short-term rental software provider Hostaway, appeared on the Alex & Annie Vacation Rental Podcast in June, and talked about how he was staying for a week at an illegal short-term rental in the city. “Originally I booked it on Airbnb, then the listing got shut down and it got canceled. The host reached out to me and said, ‘Yo, just send the money. I’m still doing it.’”

Räder said there’s long been a gray market in New York City where people have booked condos through connections. “If you’re leaving your home for a week that you can’t afford, you have to rent it out,” he says. “Under the new regulations, they’re essentially saying, if you want to keep doing a black market, your gray market stuff, that’s OK. But Airbnb and Vrbo, you’re the bad guys. You make it visible. We need more Craigslist, we need nondescript, or no photos. That’s OK.”

Malaika, the host in Ocean Hill, Brooklyn, says she participates in a group chat with hosts and at times some of them will accept reservations that break the rules.

“We go on there and individuals take risks in times of need if it’s a personal referral to the group,” she says. “So it definitely does happen.”

As for herself, Malaika says she did an illegal rental, but just one time.

“A neighbor referred someone and they stayed here in the apartment for that one week,” Malaika says. “They paid cash for it. But that was the only time. I was so desperate that I wouldn’t be able to pay my mortgage. But I was crapping the entire time because the OSE sends people around and they could have been knocking on my door on that one day while these guests were here. So it’s almost not really worth the anxiety.”

Dennis Schaal is Skift’s Executive Editor. Contact him at d[email protected]

Graphics by Vonn Keynes

Have a confidential tip for Skift? Get in touch