If you’d asked anyone a couple of years ago for the biggest threat facing Google’s travel business, the answer would surely have been regulation.

Regulators in Europe and antitrust cases in the U.S. were putting pressure on the world’s dominant search engine. Today Google faces a second, and possibly greater risk: competition.

OpenAI, the company behind ChatGPT, recently debuted SearchGPT, a browser-based search engine that offers real-time links for news, maps, sports, weather and almost everything else.

In its launch announcement, OpenAI said travel would be a key target. “We plan to keep improving search, particularly in areas like shopping and travel, and leverage the reasoning capabilities of the OpenAI o1 series to do deeper research.”

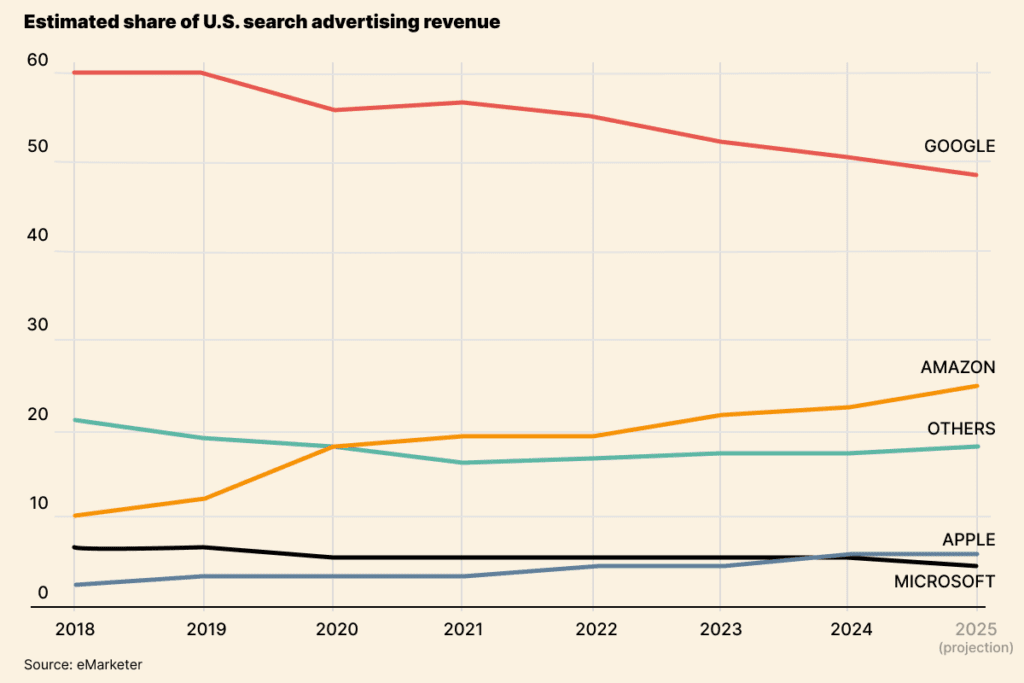

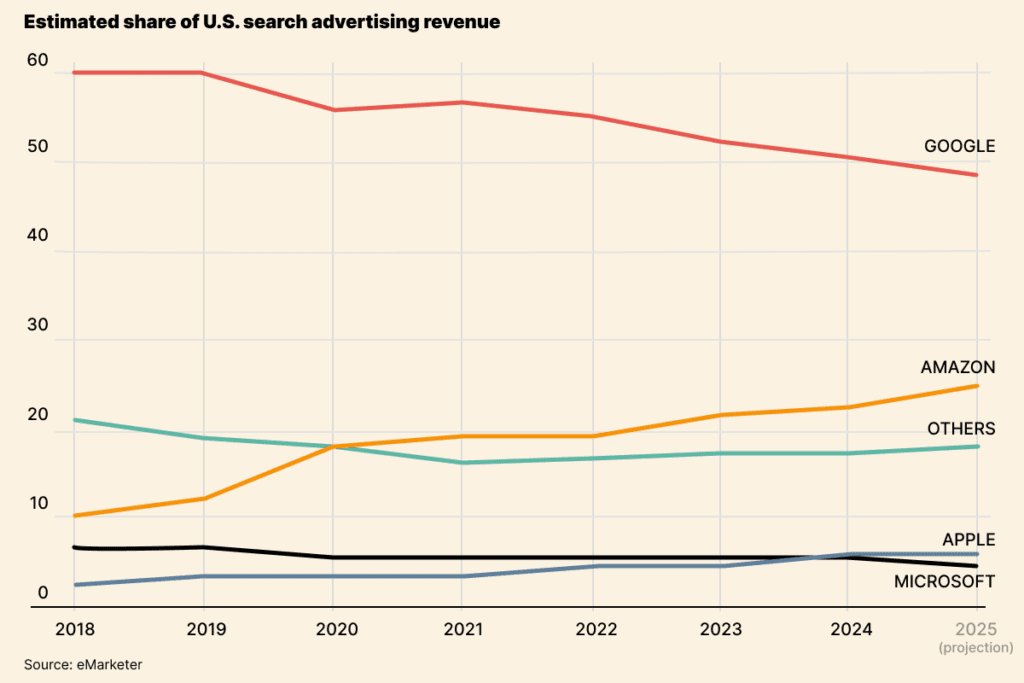

Even before OpenAI opens its platform to advertising, a move widely expected, eMarketer estimates that Google’s share of the U.S. search advertising market will fall below 50% in 2025, according to a Wall Street Journal story. That’s down from 60% in 2018.

Google has roughly a 90% hold on search queries, but the advertising market is more splintered.

Amazon and Microsoft’s Bing, which has a strategic partnership with OpenAI, are eating into Google’s search advertising market share — and more competitors are on the way.

U.S. Search Advertising Revenue 2018-2015 (Estimated)

Some 40% of Americans use TikTok as a search engine and 10% of Gen Zers favor TikTok for search over Google, according to an Adobe Express survey. Many users of TikTok, which might be banned in the U.S., search for travel on the short-video platform rather than beginning their trip-planning with Google.

TikTok has started to offer advertising formats that enable companies to target travelers, a new threat to Google’s position in travel advertising.

“The initial impact of SearchGPT is direct share loss on travel discovery queries at the top of the funnel,” Thomas Reiner, a partner at Altimeter Capital told Skift. “It will be a trickle at first, but at some point next year there will be a tangible impact to the health of the travel ad network at Google.”

That’s because in such a scenario Google would face headwinds to its search volumes, which could be supplanted by SearchGPT, voice search and other competitors. Less traffic, fewer benefits to advertisers.

Perplexity, an AI search engine that is raising $500 million at a $9 billion valuation, according to Reuters, plans to soon launch advertising, including for travel.

Google is not sitting still, of course. Google’s Deepmind unit debuted its own large language models when it launched Gemini in late 2023.

In May, leveraging its Gemini generative AI, Google introduced AI Overviews in the U.S. atop traditional search results to help people find quick answers as a supplement to clicking on search results and navigating from site to site. The latter process seems outdated and inefficient today.

In October, Google announced it was expanding AI Overviews to more than 100 countries.

“With AI Overviews in Search, it’s easier than ever for people to find the information they need and discover relevant sites across the web, which opens up more opportunities to connect with publishers, businesses and creators,” wrote Srinivasan (Cheenu) Venkatachary, Google’s VP, Search Quality, in a blog post.

A Google spokesperson said the company is investing in AI companywide, including in Gemini and Maps. Voice search is also a priority.

As of this writing, Google has not yet launched generative AI features in Google Travel, where advertisers post links and there are free links for flights, hotels, and vacation rentals.

So won’t Google, with all its resources, be able to catch OpenAI and other generative AI competitors?

“From a pure technological perspective I expect Google to heavily invest and Gemini will remain a cutting-edge frontier model,” Reiner said. “The biggest challenge at Google remains the innovator’s dilemma. The adoption of SGE (Search Generative Experience i.e. AI Overviews) within search results has had minimal impact on monetization as they’ve ramped up ad load.”

Multiple Regulatory Challenges

Google still faces multiple regulatory challenges in the U.S. and EU. In the U.S., it’s anyone’s guess what approach the incoming Trump administration will take toward Big Tech. Trump has nominated Brendan Carr, who wants to crack down on major tech companies, to head the FCC. During his presidency, Trump complained that Google’s search results were “rigged” to emphasize negative news about him.

However, Elon Musk, who runs SpaceX and Tesla, has become an influential Trump advisor. And major tech CEOs, including Google’s Sundar Pichai, had conversations with Trump during the recent presidential campaign, hoping to improve relations.

Monopoly Power

Among several pending cases in the U.S., in August 2024 a federal judge ruled that Google wields “monopoly power,” enabling it to “increase text ads prices without any meaningful competitive constraint.”

A potentially drawn out legal drama is under way to consider whether the judge should issue an order to break up Google or mandate other remedies. The judge is slated to make a decision by summer 2025. Google plans to appeal the August decision.

“This decision recognizes that Google offers the best search engine, but concludes that we shouldn’t be allowed to make it easily available,” said Kent Walker, president, Google Global Affairs, in a statement. “We appreciate the Court’s finding that Google is ‘the industry’s highest quality search engine, which has earned Google the trust of hundreds of millions of daily users,’ that Google ‘has long been the best search engine, particularly on mobile devices,’ ‘has continued to innovate in search’ and that ‘Apple and Mozilla occasionally assess Google’s search quality relative to its rivals and find Google’s to be superior.’”

Walker said people are increasingly looking for new ways to access information. “As this process continues, we will remain focused on making products that people find helpful and easy to use,” he added.

Even if Google manages to dodge the bullet regulation-wise in the U.S., Reiner argues that it may turn into only “a slight benefit” for the company in the long term.

“OpenAI has already achieved escape velocity on search and consumer mindshare,” he says.